Will Alternatives Investments Play a Larger Role in DC Plans?

The global expansion we have experienced has provided investment conditions in which a relatively simple combination of stocks and bonds has achieved sufficient diversification to manage risk. As economic conditions change further diversification may need to play a...

Spring-Clean Your Finances: 10 Tips to Boost Savings

Find areas in your budget that you may be able to live without. Here are 10 quick and easy ideas for generating an extra $250 a month that can be used to pay down debt or redirect to your retirement savings: Savings Idea / Minimum Monthly Savings Cut out the boutique...

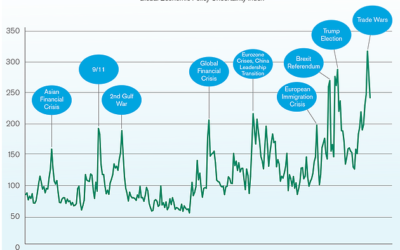

Market Uncertainty & Diversification

We live in an uncertain world. Unfortunately for investors, too much uncertainty gives the market a terrible case of heartburn. Even though the market has posted a healthy start to the year, apprehension remains. Three Top Contributors to Current Market Jitters: Signs...

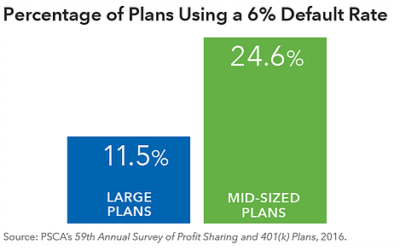

Keys to Improving Participant Retirement Outcomes

Are Americans saving enough for retirement? Not according to conventional measurements, but the trend is improving as more attention is being paid to retirement readiness. Here are five essential ingredients for plan sponsors to encourage better participant outcomes....

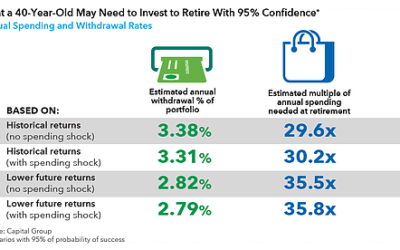

Trying to Retire Early? Key Considerations to Think About

Can I retire now?” used to be something you’d expect a 55-year-old to ask. But now, young, high-net worth individuals, in their 40s or even younger, might be thinking about the same thing. Here’s the challenge: Assumptions used in traditional retirement planning don’t...

How to Help Participants Make Better 401(k) Choices

U.S. equity funds are the largest asset category in the defined contribution system, (401(k),403(b), 457(b) plans etc.), representing 35% of all retirement plan assets. When selecting equity options for their participants, plan sponsors face a dizzying set of...