1. Watching from the Sidelines May Cost You

When markets become volatile, a lot of people try to guess when stocks will bottom out. In the meantime, they often park their investments in cash. But just as many investors are slow to recognize a retreating stock market, many also fail to see an upward trend in the market until after they have missed opportunities for gains. Missing out on these opportunities can take a big bite out of your returns. Consider that in the 12 months following the end of a bear market, a fully invested stock portfolio had an average total return of 37.4%. However, if an investor missed the first six months of the recovery by holding cash, their return would have been only 7.5%. 1

The table below is a hypothetical illustration showing the risk of trying to time the market. By missing just a few of the stock market’s best single-day advances, you could put a real crimp in your potential returns.

2. Dollar-Cost Averaging makes it Easier to Cope with Volatility

Most people are quick to agree that volatile markets may present buying opportunities for investors with a long-term horizon. But mustering the discipline to make purchases during a volatile market can be difficult. You can’t help wondering, “Is this really the right time to buy?”

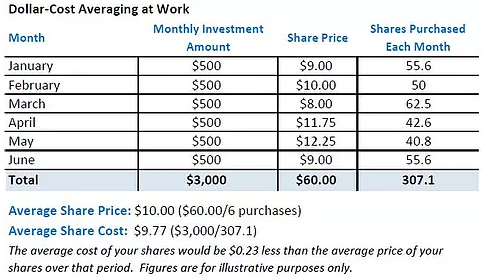

Dollar-cost averaging can help reduce anxiety about the investment process. Simply put, dollar-cost averaging is committing a fixed amount of money at regular intervals to an investment. You buy more shares when prices are low and fewer shares when prices are high, and over time, your average cost per share may be less than the average price per share. Dollar-cost averaging involves a continuous, disciplined investment in fund shares, regardless of fluctuating price levels. Investors should consider their financial ability to continue purchases through periods of low price levels or changing economic conditions. Such a plan does not guarantee a profit or eliminate risk, nor does it protect against loss in a declining market.

3. Now could be a Great Time for a Portfolio Checkup

Is your portfolio as diversified as you think it is? Your portfolio’s weightings in different asset classes may shift over time as one investment performs better or worse than another. You should re-examine your portfolio to see if you are properly diversified. You can also determine whether your current portfolio mix is still a suitable match with your time frame, goals and risk tolerance.

4. Tune Out the Noise & Gain a Longer Term Perspective

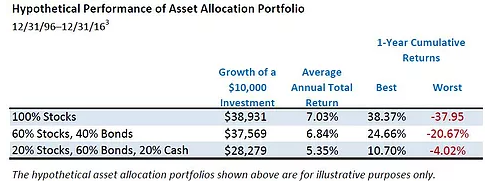

Numerous television stations, websites and social media channels are dedicated to reporting investment news 24 hours a day, seven days a week. What’s more, there are almost too many financial publications to count. While the media provides a valuable service, they typically offer a very short-term outlook. To put your own investment plan in a longer-term perspective and bolster your confidence, you may want to look at how different types of portfolios have performed over time.

5. Believe Your Beliefs & Doubt your Doubts

There are no real secrets to managing volatility. Most investors already know that the best way to navigate a choppy market is to have a good long-term plan and a well-diversified portfolio. But sticking to these fundamental beliefs is sometimes easier said than done. When put to the test, you sometimes begin doubting your beliefs and believing your doubts, which can lead to short-term moves that divert you from your long-term goals.</div><div>A Few Words about Asset Allocation

While asset allocation can be a valuable tool to help reduce volatility, all investments involve risk, including possible loss of principal. Typically, the more aggressive the investment or the greater the potential return, the more risk involved. Generally, investors should be comfortable with some fluctuation in the value of their investments, especially over the short term. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in a fund adjust to a rise in interest rates, that fund’s share price may decline. Foreign investing carries additional risks such as currency, market volatility and political or social instability; risks which are heightened in developing countries. Diversification does not guarantee a profit or protect against loss.

1. Source: © 2016 Ned Davis Research Group, Inc. Ned Davis Research defines a bear market as a 30% drop in the Dow Jones Industrial Average after 50 calendar days or a 13% decline after 145 calendar days. Reversals of 30% in the Value Line Geometric Index also qualify. As of 12/31/16, 28 bear markets were analyzed from 9/3/29 through 10/3/11. For illustrative purposes only. Indexes are unmanaged, and one cannot invest directly in an index.

2. Source: Standard & Poor’s. Indexes are unmanaged, and one cannot invest directly in an index. They do not reflect any fees, expenses or other charges.

3. Source: © 2017 Morningstar, Inc., 12/31/16. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results. Stock investments are represented by equal investments in the S&P 500 Index, Russell 2000® Index, and MSCI EAFE Index, representing large U.S. stocks, small U.S. stocks, and foreign stocks, respectively. Bonds are represented by the Barclays U.S. Aggregate Index. Cash equivalents are represented by the Payden & Rygel 90-Day U.S. Treasury Bill Index. Portfolios are rebalanced annually. Indexes are unmanaged, and one cannot invest directly in an index. They do not reflect any fees, expenses or sales charges.