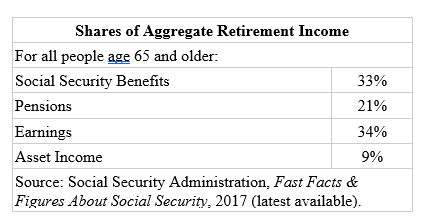

Social Security benefits currently represent about a third of the aggregate total income of Americans aged 65 and older, according to the Social Security Administration. For future generations of retirees, Social Security may represent a much smaller percentage of retirement income.

A System at Risk

When Social Security was established in 1935, the average life span among Americans was 63 years. Today, the life expectancy for a newborn is 76.4 years, according to the Center for Disease Control mortality statistics.

In 1950, 16.5 workers paid retirement benefits for each retiree. Today, there are only 2.7 covered workers per each Social Security beneficiary. And by the year 2035, the ratio may be approaching just over two workers to every one retiree. By then, the burden of taxes on each worker may well be unmanageable. This aging of the population has led some experts to predict that the Social Security Old Age and Survivors Insurance Trust Fund may run out of assets by the year 2034, a possibility that makes building your own funds for retirement more important than ever.

Does all of this mean you will have no Social Security to draw on when you retire? While an exact timetable of what will happen to Social Security is uncertain, present trends clearly indicate that your own efforts to build financial security for your retirement years are more crucial than ever. The time to begin planning for retirement — no matter your age — is now.

Even under the best scenario, the Social Security system was created as the foundation for retirement, but it was never intended to provide the sum total of financial security during the retirement years. So the more you can do for yourself to save and invest for retirement, the better off you may be.

How Much Will Social Security Pay?

The exact amount of your Social Security benefit will depend upon your earnings history. You can obtain an estimate of your benefits at the Social Security Administration’s online estimator. You can also call the Social Security toll-free number at (800) 772-1213 and request form SSA 7004, the “Request for Personal Earnings and Benefit Estimate Statement.” Complete the form and send it back. You will receive a personalized estimate of your benefits, plus a statement showing your annual earnings. Like reconciling your bank statement, your Social Security summary of annual earnings should be verified against your tax return statements, W2 forms, or your own records. If there are any discrepancies, report them at once.

How Social Security Works

Social Security contributions are paid by you and your employer. Your contributions were deducted from your paychecks since the day you started working and are matched by an equal amount paid by your employer. These contributions pay for:

Retirement benefits — Collectible at any time after age 62 and based on the number of years you’ve been working and the amount you’ve earned. In some cases, your children and your spouse may also be eligible for benefits on your account.

Survivor’s benefits — A kind of life insurance coverage available to your spouse and dependents.

Disability insurance — Provides a monthly income in the event you are unable to work due to a disability. Eligibility depends on the number of “credits” you have earned and your age.

Medicare — Entitles you to medical benefits and coverage, including hospital insurance after age 65. Bear in mind that Medicare is also experiencing funding issues, and the Hospital Insurance Fund could run out by 2028.

Social Security Benefits for Other Family Members

When you receive Social Security benefits, other payments may also be made to:

- A spouse age 62 or older.

- A spouse under age 62 who is caring for a child under 16 or a disabled child who is receiving benefits from your earnings.

- Unmarried children under 18 (or under 19) if they are enrolled full time in high school.

When You Retire Determines What You Get

- Currently, you can retire at normal retirement age (between age 66 and age 67 depending on when you were born) and receive full benefits.

- Retire between 62 and normal retirement age and receive a reduced benefit.

- Continue working and delay the receipt of benefits and get a bonus for each year of work past normal retirement age, up to age 70. “Delayed retirement credits” currently amount to 8% in order to encourage later retirement.

Changes in Your Monthly Benefits

Your monthly Social Security check may change to reflect the following:

- Cost-of-living increases.

- Eligibility for disability benefits after retirement but before you reach normal retirement age.

Make the Most of Your Benefits

You must apply for Social Security benefits and for Medicare benefits. If additional insurance is being considered, remember to apply within six months of Medicare eligibility to be accepted without regard to preexisting conditions. When you apply, you’ll want to:

- Decide whether you’ll collect your own Social Security benefits, based on your earnings and work history, or your spouse’s. Presumably, you’ll want to choose the one that pays the most. If you retire before a spouse, you can collect your own benefits, then switch and choose the spousal benefits if they are greater.

- Remember to apply for retirement benefits a few months before you want them to start. Some time is required to process all the paperwork, including Social Security number, proof of age, and evidence of recent earnings (W-2 forms from the last two years, or, if you’re self-employed, copies of your two most recent tax returns).

- Apply for Medicare before you retire.

- Apply for any additional health insurance within six months of Medicare eligibility.

- Reconcile your Social Security earnings report with your own records at three-year intervals. Report any discrepancies.

- Bear in mind that “earnings limitations” (which change each year) may limit the amount you may earn while still receiving Social Security benefits. Those limitations end when you reach normal retirement age.

- Keep Social Security records up to date if you change your name in order to have your earnings credited properly.

Regardless of your Social Security options, think of Social Security as only a small percentage of your total retirement plan, and set aside a portion of your income on a regular basis. Saving and investing for your own retirement nest egg is a “must.”