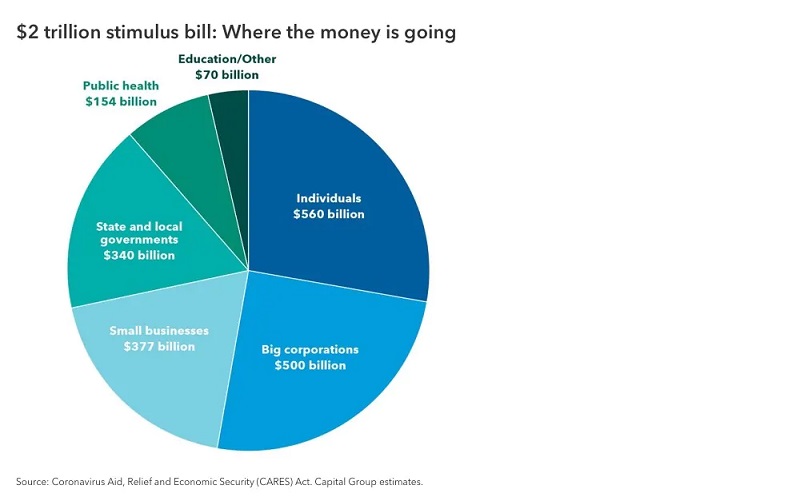

The Coronavirus Aid, Relief and Economic Security (CARES) Act is an estimated $2 trillion federal relief package designed to combat the harmful economic effects of the COVID-19 pandemic. The law looks to provide cash infusions to individuals, businesses, health care organizations and state/local governments through payments, loans and tax credits.

The CARES Act, which congressional leaders put together and sent to the president’s desk in essentially warp speed, is designed to help businesses stay afloat and, crucially, afford to continue to pay employees, during coronavirus-mandated shutdowns.

Still, there are already questions about specific program details and concerns that more aid will be needed. As Washington continues to consider additional economic aid and relief measures, we want to highlight some of the CARES provisions that we believe will be of interest to you.

What Individuals Need to Know

Whether you participate in your company’s 401(k) plan, have a traditional or small business IRA, or you are in charge of a plan at your company, here are three key things to be aware of:

1. Special tax rules for coronavirus-related distributions

For retirement savers who need to tap tax-deferred savings during this time of need, the CARES Act creates new rules for a coronavirus-related distribution (CRD) of up to $100,000 that includes four key benefits:

-

It cushions the blow by waiving the 10% early-withdrawal penalty.

-

While income taxes are still owed on CRDs, taxpayers can spread the payments out over the next three years.

-

Withdrawals can be repaid to the retirement account within three years of the distribution. If repaid, any amount previously included in income could be exempted by filing a corrected return for the previous year.

-

It’s not subject to otherwise mandatory 20% tax withholding.

The ability to take CRD applies to anyone who has been diagnosed or whose spouse or dependent has been diagnosed with COVID-19, or who is experiencing adverse financial consequences as a result of being quarantined, furloughed, laid off, experiencing reduced work hours or lacking child care because of the coronavirus. Business owners who have to close or reduce business hours would also qualify.

Unless such a special distribution is urgently needed, however, it’s generally recommended that people continue to take advantage of tax-deferred growth and not take early distributions from their retirement accounts.

2. Suspended RMDs for retirement accounts

For retirement savers who prefer to delay distributions this year, required minimum distributions (RMDs) are suspended in 2020 for retirement account owners and beneficiaries. This applies to traditional, SEP and SIMPLE individual retirement accounts, as well as 401(k), 403(b) and governmental 457(b) plans. It means that individuals who turned 70½ in 2019 and were waiting until April 15, 2020, to take their RMDs now have until the end of 2021 to start taking distributions. Those who delayed first-time distributions in 2019 may skip RMDs for 2019 and 2020. Individuals who are already taking distributions may skip the 2020 RMD. However, an RMD may still make sense for someone in need of income or who expects to be in a lower tax bracket this year.

Those who have taken an RMD in the past 60 days may have the option to undo it. If it’s returned to the retirement account, the distribution will be treated as a 60-day rollover. However, the person doing the rollover needs to be eligible for a 60-day rollover, which wouldn’t include nonspouse beneficiaries. If it’s been more than 60 days, there may still be an opportunity for a rollover.

3. Beneficiary IRA distributions suspended

The suspension of RMDs in 2020 applies to inherited IRAs as well. Retirement accounts that are currently subject to the five-year rule following the account owner’s death (generally, retirement accounts payable to an estate or other entity that did not qualify for stretch treatment) may skip counting 2020 among the five years. This means for a beneficiary subject to the five-year rule who inherited a retirement account between 2015 and 2019, the five-year rule is effectively a six-year rule.

What Small Business Owners Need to Know

If you are a small business owner, self-employed or working for a small company, here are three key things to be aware of:

1. Paycheck Protection Program Loans

Businesses with fewer than 500 employees, including sole proprietors, independent contractors, “gig economy” workers and anyone otherwise self-employed, can apply for loans of up to $10 million, or 2.5 times total payroll expenses for the loan period.

Those who are able to access funds can use them to help pay for payroll costs and other expenses, such as mortgage payments, rent, utilities and other debt service from February 15 to June 30. At least 75% of the loan must be payroll and payroll costs (salary, wages, commissions and tips) are capped at $100,000 for each employee.

The loans are fully guaranteed by the federal government through the end of 2020 and can have a maturity of up to 10 years. Business owners will be able to apply for these loans at any lending institution approved to participate in the program through the existing U.S. Small Business Administration’s 7(a) lending program.

Other notable provisions to the loan program:

The portion of the Paycheck Protection Program Loan that was used for the first eight weeks of payroll costs, interest on mortgage obligations, rent and utilities is eligible for permanent forgiveness.

Payments of principal and interest can be deferred for at least six months and for no more than one year. The interest rate is capped at 4%.

Businesses that laid off workers from February 15 to April 26 can be eligible for credit for loan forgiveness as long as those jobs and salaries are reinstated by June 30.

501(c)(3) charitable organizations with fewer than 500 workers can qualify as well. All entities must have been in operation as of February 15, 2020.

2. Expansion of the SBA Disaster Loan Program

This expansion enables sole proprietors to access disaster loans and enables them to receive a working capital loan to overcome the temporary loss of revenue. Entities that apply for a disaster loan can get an immediate advance of up to $10,000 to maintain payroll, and the advanced $10,000 does not have to be repaid even if the full loan application is later denied.

3. Other benefits for businesses

The employer’s portion of Social Security payroll tax payable in 2020 may be deferred until January 1, 2021, with the first half of the deferred 2020 payment due at the end of 2021 and the second half due at the end of 2022.

Employers may be eligible for up to one year of credit against the employer’s 6.2% share of Social Security tax for a business that is fully or partially suspended due to government orders, or where revenue in a quarter in 2020 is less than 50% of the revenue in the same quarter last year. Employers may be eligible for more flexible net operating loss rules for access to an immediate refund.