The retirement plan industry is constantly evolving. To keep pace, plan fiduciaries should be continuously evaluating their approach to plan design and governance. In today’s environment of increased litigation and plan design innovation, having a highly effective retirement plan committee has never been so important.

An effective committee can help fulfill fiduciary responsibilities, navigate increasingly complex plan requirements and minimize the risk of litigation. At the same time, the committee is charged with staying on top of innovations and emerging trends that may have the potential to impact their plan participants’ outcomes. Today’s workforce is getting older and spanning more generations, is much more diverse than ever before and is more highly educated. This is good news on many levels. Numerous studies show that more diversity across the workforce leads to better results.

If academics, corporate boards, juries and employees all benefit from diversity, we can assume retirement plan committees can benefit too. But, we don’t have to assume. Studies have also shown that diverse committees achieve better decisions than those that are less diverse. Adopting an inclusive and diverse approach can bring a wide range of perspectives, allowing the committee to better serve participants from all demographics. Having different backgrounds can help create a strong governance structure.

Best Practices of Highly Effective Plan Committees

While there are many factors that contribute to the effectiveness of a committee, diversity should be considered as a key component. Consider these best practices when forming or evaluating your retirement plan committee.

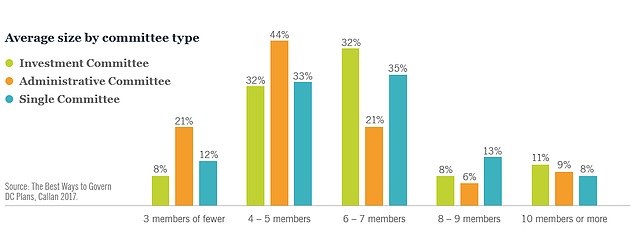

First is determining the right size for the committee. Depending on plan size, committees typically range from three to nine members, though five seems to be the ideal recommendation for effective decision-making. An odd (not even) number of members helps eliminate the risk of a tie and indecision. It is also a good idea to appoint a chairperson and a secretary to ensure that a proper cadence is followed and detailed records are kept.

Consider how diverse characteristics could enhance the committee decision-making through different perspectives. Generally, there is representation from human resources, finance and legal. While committee members don’t need to be experts in investing, they should have a basic understanding of retirement plans and/or financial markets.

A prudent committee may also develop a charter to outline fiduciary responsibilities and ongoing governance required to oversee a retirement plan. The charter should clearly reflect the committee’s structure, as well as the committee’s member roles, objectives and responsibilities consistent with ERISA’s guiding principles.

Basics of committee charter:

- Establish the committee’s authority

- Define the committee’s purpose

- Determine the committee’s structure

- Formalize the committee’s procedures

- Delegate authority and assign responsibilities and duties

- Create processing for selecting and managing vendors

- Outline the committee’s reporting needs

- Set procedures for performing updates and protecting committee members financially

Following a thorough and prudent process will help enable the committee to effectively fulfill its fiduciary obligations. It is critical to have through documentation not only around plan decisions, but also the logic that was applied in order to come to those conclusions.

- Written fiduciary acknowledgment for committee members

- Investment policy statement

- Meeting minutes

Participants have a variety of unique needs, so it’s imperative to have a broadened perspective and deeper understanding of whom the committee is there to serve. An effective plan committee is the foundation of retirement plan decision-making and the key to building a plan that helps participants reach successful retirement outcomes.