Here’s what is important to consider when reviewing stable value options for retirement plans.

Stable value funds have long been a fixture in defined contribution plans, with more than $800 billion in assets and a large majority, 75% of DC plans, offering them as an investment option. Stable value has evolved beyond being simply a standalone capital preservation option to now serving as a key component in today’s model portfolios, target date funds and managed accounts.

What Is a Stable Value Fund?

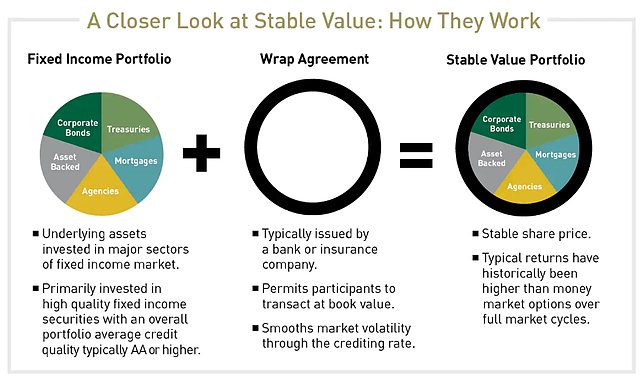

Offered only in defined contribution plans, a stable value fund is an investment vehicle that generally invests in high quality fixed income portfolios through contracts with banks and insurance companies, known as “wraps.” These wrap contracts provide participants with a guarantee of principal along with a competitive rate of interest while enabling plan participants to transact at contract value regardless of the market value of the underlying investments. In essence, these contracts smooth the volatility for participants in the fund through the crediting rate.

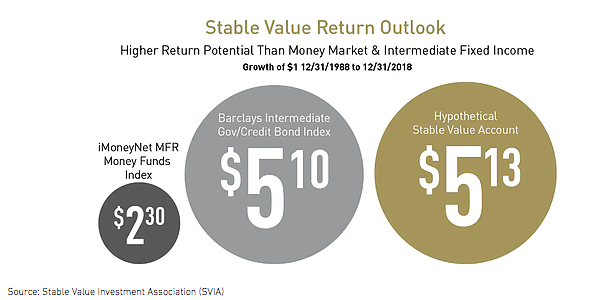

Stable value has traditionally been known as a low-risk, principal-preservation option in the investment menu. Historically, these options have provided long-term returns similar to intermediate-term bond funds, without the corresponding volatility.

What are the Potential Benefits of Stable Value for Plan Sponsors and Participants?

A stable value option can be an attractive investment for retirement plan participants within their overall portfolio. With a stable rate of interest and protection of principal, they are considered a substitute for a short or intermediate-term bond fund. Key features of a stable value option include:

- Capital preservation

- Stability of growth in principle and earned interest

- Returns similar to investment grade bonds with less volatility

Stable Value vs. Money Market Options: What are Some Considerations

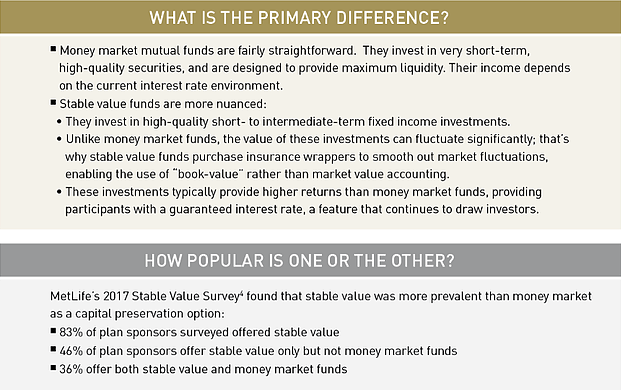

Since both options are commonly used to protect participants’ principal, it’s worth asking the question: What is the difference?

What are the Experts Saying?

Stable value funds have long been a mainstay in defined contribution plans for good reason because they can offer the attractive benefits of principal preservation, volatility smoothing and a steady competitive interest rate. Experts say that stable value has evolved to accommodate the emerging needs of plan sponsors in constructing a diversified investment menu.

Karl Tourville, Founding Managing Partner and President of Galliard Capital Management, says the stable value industry has adapted and thrived through many changing environments, and he suggested that now it may be in its “golden age.”

Key Ingredient in Both Off-the-Shelf and Custom Target Date Options

Warren Howe, National Sales Director, Stable Value Markets at MetLife, believes there are good reasons for stable value’s continued longevity and strength. “A key trend we are seeing is stable value’s growing inclusion in options such as target date funds, both off the shelf and custom target date funds, as well as model portfolios,” he says. “We see custom target date funds among larger plans that are interested in leveraging stable value and the other investment options from their core menu and creating a custom glide path that better fits the needs of their employee demographics. It becomes even more important as participants near retirement that the glide paths utilize an option such as stable value to preserve and protect their savings.”

When constructing custom options, Howe sees three contributors to stable value’s strength: “One, it’s less expensive, because you are leveraging the scale of the assets from the core investment options and not adding additional funds and the associated asset management and recordkeeping costs. Two, a plan sponsor has already done the due diligence to select the most appropriate investment options for their participants, so these options are already thoroughly vetted. And three, unlike with an “off the shelf” target date option, with a custom option, a plan sponsor retains the flexibility to replace a manager if they are unhappy with any component of the structure or its performance."

The Moving Parts of Stable Value Funds

Stable value options have distinct structures, features and risks. To properly evaluate a stable value fund, plan sponsors should understand how they are structured and what influences their performance. The chart below illustrates how a stable value fund is constructed.

What to be Aware of as a Fiduciary

From a retirement plan fiduciary standpoint, it’s critical to frequently review all the options on the plan menu and ensure that participants have access to a good variety of prudent investment options. Often that means including stable value among the choices.

As you perform your due diligence on available stable value options, it’s important to have a good understanding of how these products are constructed and use a thorough, documented process for evaluating them. While stable value funds may not be as transparent as money market funds, their components can be explained and understood. Plan fiduciaries should review, among other things, the investment manager, performance history, and the underlying investment portfolio in order to evaluate risk, duration, sector allocation, and other significant data.

Because their structure includes insurance “wrappers,” this can pose a challenge to evaluate the different wrap contracts. The benefit provided by the wrap contract(s), however, is the distinguishing characteristic of a stable value solution. That’s why it’s important that appropriate due diligence review includes the fund guarantee providers.

Another consideration is the structure of the stable value offering being utilized. Two commonly used structures are insurance company general account solutions and pooled stable value collective investment trusts. Each features a wrap contract with one or more guarantors that provides principal preservation, benefit responsiveness and a guaranteed interest rate. There are two main differences, however:

- General Account: The interest rate is determined by the insurance company and the return is backed by the assets of the insurer’s general account.

- Pooled Fund – The interest rate is determined based upon a clearly defined crediting rate formula and the return is supported by assets held in an external trust.

A pooled structure offers more transparency and clarity, with visibility to the underlying assets you can monitor and evaluate.

Ask us about how we can assist you in evaluating stable value products that best meet the needs of your plan participants. Together, we can put all the resources and solutions to work for your employees.