Are Americans saving enough for retirement? Not according to conventional measurements, but the trend is improving as more attention is being paid to retirement readiness. Here are five essential ingredients for plan sponsors to encourage better participant outcomes.

1. Use Auto Provisions to Build on the Progress Made in Improving Retirement Savings

The shift from defined benefit to defined contribution plans over the past 35 years has created a new retirement reality where employees contribute most of the money and make most of the decisions. To help employers encourage better saving and investing behaviors, the Pension Protection Act of 2006 (PPA) introduced a host of features — like automatic enrollment, automatic escalation and investment reenrollment — that have led to measurable improvement in savings and participation rates.

Before PPA, retirees had saved only a fraction more than their final yearly salary on average. Ten years later, they have 4.5 times their final earnings saved at retirement. For example, what would have been a $100,000 retirement nest egg is now $450,000. This is a great start that should encourage plan sponsors to maximize the auto features available in their plans.

2. Increase Salary Reduction Default Rates So Participants Save More.

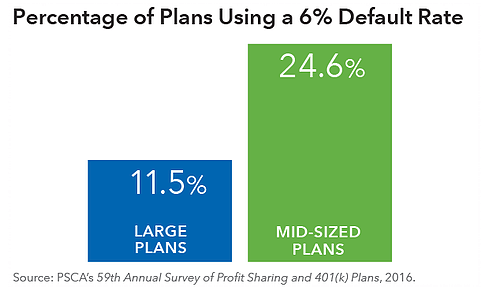

The most common auto feature, auto-enrollment, is now used by 88.6% of defined contribution plans. With more people saving for retirement, employers are starting to boost average participant savings by employing another auto-feature: auto-increase. A typical strategy is to ramp up the default contribution percentage from 3% to 6%.

Mid-sized plans—those between 1,000 and 4,999 participants— are leading the way, with significantly higher use of auto-enrollment than plans above 5,000 participants. Yet despite a default rate more than twice as high as the largest plans, the opt-out rates are exactly the same: 7.6%. So participants aren’t opting out in droves if plans boost the default rate to 6%. They may in fact be recognizing the importance of sacrificing a little now in the interest of retirement security.

3. Choose Default Fund Series Wisely.

There’s still the matter of where the contributions will be invested. The PPA also created “safe harbor” default investments for participants lacking the time or expertise to select their own retirement investments. The most common Qualified Default Investment Alternative (QDIA) is a target date series, which provides a one-stop diversified investment based on the participant’s age. Other possible default options include balance funds or managed accounts.

The success of target date funds has made the selection of a target date provider one of the most important investment decisions a plan sponsor makes. There are many factors to consider when selecting a target date provider, including track record, fees, "glide path" of investment allocations, experience, long-term approach to investing and the quality of the underlying funds.

4. Increase Diversification by Simplifying DC Plan Lineups.

What about the participants who make their own investment decisions? To serve them, retirement plans have significantly increased the number of investment menu options in recent decades. This was done in the interest of providing better choice and diversification to participants, but it’s reached the point where the average defined contribution plan has 19 separate investment choices.

Is that too much choice? Fear, indecision, procrastination, and irrational investment decisions occur when participants feel confused or overwhelmed. To ensure participants make the best possible decisions, plan sponsors can simplify their choices by merging the existing investment menu into broader and more flexible options that cover the same spectrum of underlying securities. This not only ensures wide diversification, it may result in better outcomes as well.

Shoppers don’t usually make buying decisions based on where the product was made; neither should investors, especially in the new reality of global investing. Geographical flexibility has delivered more excess return relative to the benchmark over the past decade than investing in U.S. or international alone.

5. Keep the Momentum Going With Investment Re-Enrollment.

It’s not enough for participants to set savings aside and choose appropriate investments. They also need to stay on track with their goals over time as markets and personal situations change. Investment re-enrollment is a great tool to do just that.

Before investment re-enrollment, allocations can become unbalanced over time, as participants frequently don’t make any attempt to change or rebalance their original investment choices. After investment re-enrollment, the majority of participants are reset close to the glide path, so their investment allocation matches the one that would be most appropriate at that stage of life.

Investment re-enrollment can be surprisingly easy to implement. Participants can opt-out of having their investments reset if they choose, and the company can do it one time or as many times as they like.

6. Education, Education and More Education for Employees.

In the current retirement plan landscape, employers are paying closer attention to their retirement benefit plans today, more than ever before. A plan sponsor could offer automatic enrollment, automatic escalation of employees’ deferral rates, a prudent QDIA, a complimentary simplified investment menu, low fees and great technology for plan participants and it may still not be enough. Most people will need constant education to consistently make the right decisions to achieve their retirement goals. After all, we are asking the average person to act like their own personal investment manager, actuary and financial planner. Most would confess that they do not have the knowledge nor the desire to learn about these skills.

Employers should design an education plan that addresses this common behavior. Most participant learning styles are not the same and they also have preferences on how they like to be educated. A well rounded education plan should incorporate several, if not all, of these ideas:

Employers should design an education plan that addresses this common behavior. Most participant learning styles are not the same and they also have preferences on how they like to be educated. A well rounded education plan should incorporate several, if not all, of these ideas:

- Direct mail & e-mail

- Group presentations onside & over the web

- General education content such as a newsletter

- Proactive education to specific groups of employees

- Health & financial wellness programs that can address financial obstacles that could be preventing employees from saving or not saving enough

- The opportunity to talk to someone and get help with enrolling into the plan, planning for retirement and addressing questions around the investment options, etc.

Best of all, like most of the ideas discussed, participants may appreciate it. They respect that their employer is making it easier for them to stay on top of their retirement goals.

*****

Past results are not predictive of results in future periods. Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.